Introduction

The financial industry is one of the most dynamic and competitive sectors in the world. Professionals in this field are constantly seeking ways to enhance their credentials, improve their expertise, and stand out in a crowded marketplace. One of the most respected certifications in the financial advisory and trust management space is the Certified Trust and Financial Advisor (CTFA) designation. This certification, offered by the American Bankers Association (ABA), is a hallmark of excellence and expertise in trust and wealth management.

In this comprehensive article, we will explore the CTFA exam in detail, including its significance, structure, and preparation strategies. We will also discuss the role of the CTFA certification in the broader context of ABA certifications and how it can benefit financial professionals. Additionally, we will highlight the value of using resources like DumpsArena, a trusted platform for exam preparation, to ensure success in the CTFA exam.

What is the CTFA Certification?

The Certified Trust and Financial Advisor (CTFA) certification is a prestigious credential designed for professionals who specialize in trust and wealth management. It is awarded by the American Bankers Association (ABA), one of the most recognized and respected organizations in the banking and financial services industry.

The CTFA certification validates a professional's expertise in key areas such as fiduciary and trust activities, financial planning, tax law, and investment management. It is particularly valuable for individuals working in roles such as trust officers, financial advisors, wealth managers, and private bankers.

Why Pursue the CTFA Certification?

- Enhanced Credibility: The CTFA designation is widely recognized in the financial industry. It demonstrates a high level of competence and commitment to ethical standards, making certified professionals more attractive to employers and clients.

- Career Advancement: Earning the CTFA certification can open doors to higher-level positions and increased earning potential. Many organizations prefer or require this certification for senior roles in trust and wealth management.

- Specialized Knowledge: The CTFA curriculum covers a broad range of topics, including estate planning, tax strategies, and fiduciary responsibilities. This knowledge is invaluable for providing comprehensive financial advice to clients.

- Networking Opportunities: As a CTFA-certified professional, you gain access to a network of like-minded individuals and industry experts through the ABA and other professional organizations.

The CTFA Exam: Structure and Content

The CTFA exam is a rigorous assessment designed to test a candidate's knowledge and skills in trust and financial advisory services. To earn the certification, candidates must pass this exam, which covers four key domains:

- Fiduciary and Trust Activities (35%): This section focuses on the principles of fiduciary responsibility, trust administration, and compliance with legal and regulatory requirements.

- Financial Planning (25%): Candidates are tested on their ability to develop comprehensive financial plans, including retirement planning, risk management, and estate planning.

- Tax Law and Planning (20%): This domain covers federal and state tax laws, tax-efficient strategies, and the impact of taxes on trust and estate planning.

- Investment Management (20%): This section evaluates a candidate's understanding of investment principles, portfolio management, and asset allocation strategies.

The exam consists of 150 multiple-choice questions and must be completed within four hours. A passing score is required to earn the certification.

Preparing for the CTFA Exam

Preparing for the CTFA exam requires a combination of study materials, practical experience, and effective test-taking strategies. Here are some tips to help you succeed:

1. Understand the Exam Blueprint

Familiarize yourself with the exam content outline provided by the ABA. This will help you identify the key topics and allocate your study time accordingly.

2. Leverage Study Materials

Use a variety of resources, including textbooks, online courses, and practice exams. The ABA offers official study materials, but additional resources can provide a more comprehensive understanding of the topics.

3. Gain Practical Experience

Hands-on experience in trust and financial advisory roles is invaluable. It helps you apply theoretical knowledge to real-world scenarios, making it easier to understand complex concepts.

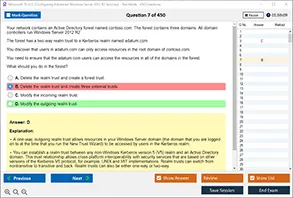

4. Take Practice Exams

Practice exams are an essential part of your preparation. They help you assess your knowledge, identify weak areas, and get accustomed to the exam format.

5. Join Study Groups

Collaborating with other candidates can provide motivation, support, and additional insights into challenging topics.

The Role of CTFA in ABA Certification

The American Bankers Association (ABA) offers a wide range of certifications for banking and financial professionals. The CTFA certification is one of the most specialized and advanced credentials in the ABA's portfolio. It complements other ABA certifications, such as the Certified Regulatory Compliance Manager (CRCM) and the Certified Wealth Strategist (CWS), by focusing specifically on trust and wealth management.

For professionals pursuing a career in banking or financial services, earning multiple ABA certifications can significantly enhance their expertise and career prospects. The CTFA certification, in particular, is highly regarded for its focus on fiduciary responsibilities and financial planning, making it a valuable addition to any financial professional's credentials.

Why Choose DumpsArena for CTFA Exam Preparation?

When it comes to preparing for the CTFA exam, having access to high-quality study materials is crucial. DumpsArena is a trusted platform that offers a wide range of resources to help candidates succeed in their certification exams. Here are some reasons why DumpsArena stands out:

1. Comprehensive Study Materials

DumpsArena provides up-to-date study guides, practice questions, and exam dumps that cover all the topics included in the CTFA exam. These materials are designed to help candidates understand complex concepts and practice their knowledge.

2. Realistic Practice Exams

The platform offers realistic practice exams that mimic the actual CTFA exam. These practice tests help candidates assess their readiness and identify areas where they need improvement.

3. Expertly Curated Content

The study materials on DumpsArena are curated by industry experts with extensive knowledge of the CTFA exam and its requirements. This ensures that candidates receive accurate and relevant information.

4. Flexible Learning Options

DumpsArena offers flexible learning options, including online access to study materials and downloadable resources. This allows candidates to study at their own pace and convenience.

5. Affordable Pricing

Compared to other exam preparation platforms, DumpsArena offers affordable pricing without compromising on the quality of its resources.

6. Positive Reviews and Success Stories

Many candidates have successfully passed the CTFA exam using DumpsArena's resources. The platform has received positive reviews for its effectiveness and reliability.

How DumpsArena Can Help You Pass the CTFA Exam?

- Targeted Preparation: DumpsArena's study materials are tailored to the CTFA exam, ensuring that you focus on the most important topics.

- Time Management: The practice exams help you develop effective time management strategies, which are crucial for completing the CTFA exam within the allotted time.

- Confidence Building: By practicing with realistic exam questions, you can build confidence and reduce exam-day anxiety.

- Performance Tracking: DumpsArena's platform allows you to track your progress and identify areas where you need to improve.

- 24/7 Support: The platform offers round-the-clock support to address any questions or concerns you may have during your preparation.

Why Choose This ABA Certification Test?

Choosing an ABA (Applied Behavior Analysis) certification test is a significant decision for professionals in the field of behavior analysis. Here are several reasons why one might choose a particular ABA certification test:

- Credibility and Recognition: A reputable ABA certification test is recognized by employers, educational institutions, and professional organizations. This recognition can enhance your professional credibility and open up more job opportunities.

- Comprehensive Coverage: A good ABA certification test will cover a wide range of topics within the field, ensuring that you have a thorough understanding of behavior analysis principles and practices.

- Alignment with BACB Standards: The Behavior Analyst Certification Board (BACB) sets the standards for ABA practice. Choosing a test that aligns with these standards ensures that you are meeting the professional requirements necessary to practice as a behavior analyst.

- Preparation for Real-World Practice: The test should prepare you for the practical aspects of being a behavior analyst, including ethical considerations, assessment techniques, intervention strategies, and data analysis.

- Continuing Education: Some certification tests offer or are part of continuing education programs that help you stay current with the latest research and developments in the field.

- Professional Development: Achieving certification can be a stepping stone for further professional development, including advanced certifications, specializations, or academic pursuits.

- Networking Opportunities: Being certified can provide access to professional networks and communities where you can share knowledge, resources, and support with peers.

- Client Trust: Certification can help build trust with clients and their families, as it demonstrates a commitment to the profession and a standardized level of expertise.

- Legal and Ethical Compliance: In some regions, having an ABA certification is a legal requirement to practice. It also ensures that you are adhering to the ethical guidelines set forth by the profession.

- Personal Achievement: Passing a rigorous certification test can be a source of personal pride and a testament to your dedication and expertise in the field of behavior analysis.

When choosing an ABA certification test, it's important to research and consider factors such as the test's reputation, the quality of the preparation materials, the pass rates, and the support provided by the certifying organization. It's also crucial to ensure that the certification is relevant to your career goals and the specific area of ABA in which you wish to practice.

What You'll Learn with DumpsArena CTFA Exam-Certified Trust and Financial Advisor?

DumpsArena offers a variety of resources to help candidates prepare for the Certified Trust and Financial Advisor (CTFA) exam. Here's what you can expect to learn and gain from using their CTFA exam preparation materials:

1. Comprehensive Coverage of Exam Topics

- DumpsArena provides study materials that cover all the key domains of the CTFA exam, including:

- Trust and Estate Planning

- Financial Planning

- Tax Planning and Compliance

- Fiduciary and Trust Activities

- Investment Management

- Ethics and Professional Responsibility

- This ensures you have a well-rounded understanding of the concepts required to pass the exam.

2. Real Exam Simulation

- The platform offers practice questions and mock exams that simulate the actual CTFA exam environment.

- This helps you familiarize yourself with the exam format, question types, and time constraints.

3. Detailed Explanations and Answers

- Each question comes with detailed explanations to help you understand the reasoning behind the correct answers.

- This reinforces your learning and helps you identify areas where you need improvement.

4. Up-to-Date Content

- DumpsArena ensures their materials are regularly updated to reflect the latest changes in the CTFA exam syllabus and industry standards.

5. Time Management Skills

- By practicing with timed mock exams, you’ll learn how to manage your time effectively during the actual exam.

6. Confidence Building

- Regular practice with DumpsArena’s resources will boost your confidence, ensuring you’re well-prepared to tackle the exam.

7. Focus on Weak Areas

- The platform often provides performance analytics, helping you identify and focus on your weak areas.

8. Ethical and Professional Standards

- Since ethics is a critical component of the CTFA exam, DumpsArena emphasizes ethical practices and professional responsibilities in their materials.

9. Practical Application

- The materials are designed to help you apply theoretical knowledge to real-world scenarios, which is essential for the CTFA exam.

10. Exam Strategies and Tips

- DumpsArena often includes tips and strategies for approaching different types of questions, helping you maximize your score.

Conclusion

The CTFA certification is a valuable credential for financial professionals seeking to advance their careers in trust and wealth management. It demonstrates a high level of expertise and commitment to ethical standards, making certified professionals stand out in a competitive industry.

Preparing for the CTFA exam requires dedication, practical experience, and access to high-quality study materials. Platforms like DumpsArena play a crucial role in helping candidates succeed by providing comprehensive resources, realistic practice exams, and expert guidance.

Whether you are a seasoned financial advisor or just starting your career in trust and wealth management, earning the CTFA certification can open doors to new opportunities and enhance your professional credibility. By leveraging the right resources and strategies, you can achieve your goal of becoming a Certified Trust and Financial Advisor and take your career to the next level.

In the ever-evolving financial industry, staying ahead of the curve is essential. The CTFA certification not only equips you with the knowledge and skills needed to excel in trust and financial advisory roles but also positions you as a trusted expert in your field. With the support of platforms like DumpsArena, you can confidently prepare for the CTFA exam and achieve your certification goals.

Invest in your future today by pursuing the CTFA certification and taking advantage of the resources available on DumpsArena. Your journey to becoming a Certified Trust and Financial Advisor starts here!

Get Accurate & Authentic 500+ CTFA Exam Questions

1. Which of the following is a primary duty of a fiduciary?

A) Maximizing personal profit

B) Acting in the best interest of the beneficiary

C) Delegating all responsibilities to a third party

D) Avoiding communication with beneficiaries

2. What is the primary purpose of a revocable living trust?

A) To avoid all taxes

B) To provide asset protection from creditors

C) To manage assets during the grantor’s lifetime and avoid probate

D) To create an irrevocable transfer of assets

3. Which of the following is NOT a fiduciary standard of care?

A) Loyalty

B) Prudence

C) Self-dealing

D) Impartiality

4. What is the annual gift tax exclusion for 2023?

A) 15,000

B)17,000

C) 12,000

D) 25,000

5. Which type of trust is often used to provide for a beneficiary with special needs without disqualifying them from government benefits?

A) Revocable trust

B) Charitable remainder trust

C) Special needs trust

D) Testamentary trust